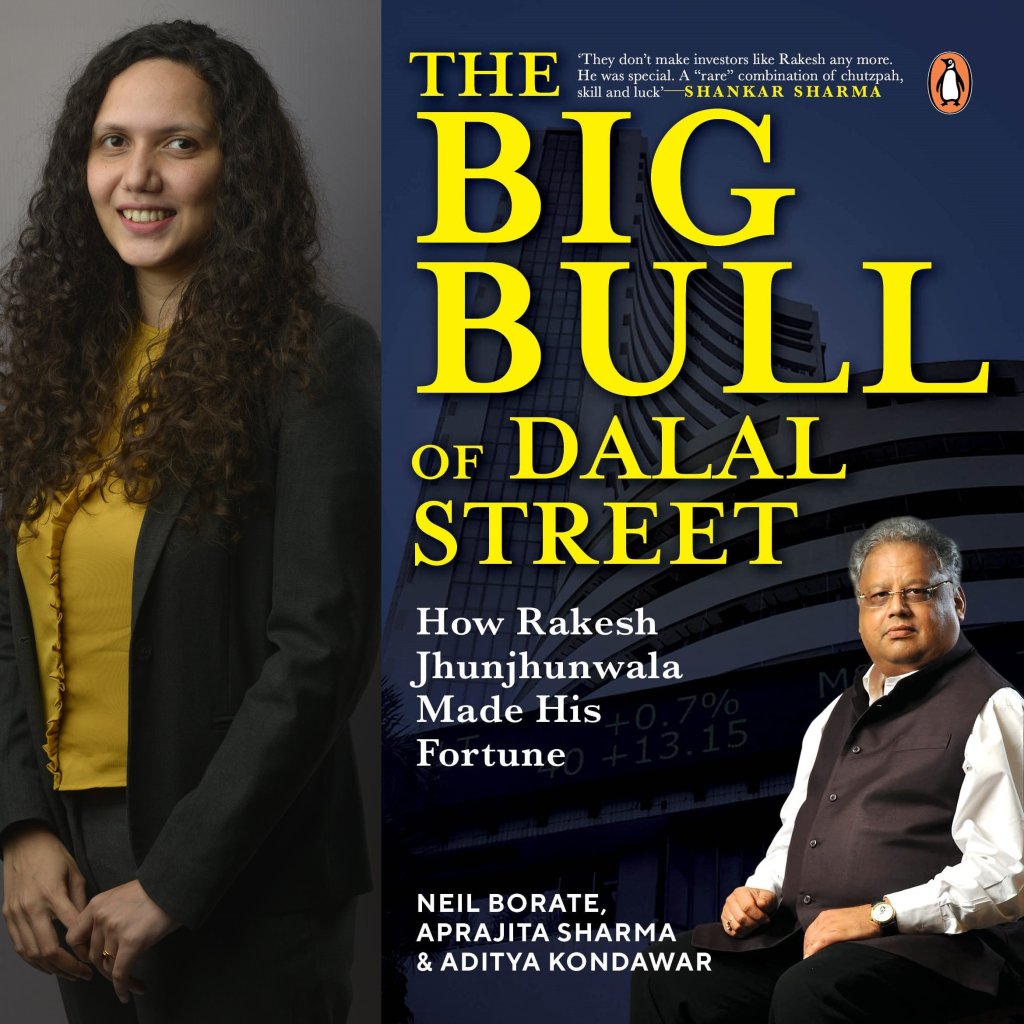

Financial journalist with Mint, Fortune India, and Outlook Money, and a certified financial planner, Aprajita is co-author of The Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune, which is due to be released later this month. With a degree in journalism from the IIMC and a healthy understanding of the financial markets developed over a decade spent working with leading publications like ET, Business Today, Business Standard, Zee Business and India Today, she is ideally suited for having co-written a book on one of the biggest legends of the Indian stock market. Here, Aprajita speaks to BooksFirst about her work as a financial journalist, the changes that the profession has seen in recent times, her book and the incomparable RJ. She also tells us about some of her own favourite books and authors.

You have been a financial journalist for around 10 years. What was it that attracted you to financial journalism, back at the time when you got started? How has financial journalism in India evolved since that time? Are things much more hectic these days?

I chanced upon journalism when I appeared for the Indian School of Mass Communication (IIMC) entrance exam. However, when I got through, I knew I wouldn’t be getting into political journalism which would have been a simple choice. Not many people intentionally opt for financial journalism, which is deemed difficult. I wanted to take the road less travelled.

No comparison between the past and now when it comes to being more hectic or less. The profession in itself is demanding. Ways of reporting and accessing sources may have changed but not the core. The major change that I have observed in the last 10 years is Web journalism. Almost all media houses have a Web team which writes content on trending topics. These are quickly-generated stories which may or may not be rich in substance. Sometimes, such easy-to-read and rich in keywords stories gain higher page views than a well-researched long-form piece. But I am hopeful. I can see that Web-only platforms have started gaining traction. Platforms such as The Ken, The Signal and The Morning Context are doing a great job at it.

With the rise of the Internet (YouTube, bloggers, vloggers, social media influencers etc.) over the last 10 years, where are print and television today vis-à-vis Web-only media?

The rise of internet that you are talking about is a recent phenomenon. It has happened post Covid-19 and I truly believe it is short-lived. It is already fading. I don’t see the death of print or TV due to this. People may have been consuming news on smartphones but what are they consuming? Content produced by print and TV. PDFs of print newspapers circulate on WhatsApp and Telegram daily. Magazines too. Magzter is a popular app that many people use to consume print content.

But, yes! Physical print copies have certainly taken a hit. Number of print pages have reduced. Jobs have reduced. So far as TV is concerned, it will always enjoy an edge when it comes to breaking news. A couple of mainstream TV channels may have behaved irrationally in the past, but they would still not become irrelevant. People in India watch TV. Period.

Print vs Web-only media debate is more relevant for journalists than readers. You cannot just be a print journalist. You need to cultivate multi-media skills. Publications would prefer hiring people who can do it all. No media house can make money solely through print copies. Revenues will come through Web, videos and events.

Coming to The Big Bull of Dalal Street, what was it that inspired you (along with your co-authors) to write a book about Rakesh Jhunjhunwala? Also, in what ways did you want your book on Jhunjhunwala to be different from other books on him, which were already there in the market?

Ours is the first mainstream book on Rakesh Jhunjhunwala. You wouldn’t find any other book worth picking up. This is precisely why we wanted to write a book about him after his sudden death. My co-author Neil Borate was already writing a book on personal finance when someone suggested he should go for a book on Rakesh Jhunjhunwala. He took me and Aditya Kondawar on board to finish this book on time.

The Big Bull of Dalal Street covers not just Jhunjhunwala’s life and early days in the stock market but also how he became so big. It has a lot of interesting anecdotes. I should emphasise we haven’t just eulogised him. There is a chapter on what NOT to learn from him. We have talked about his investments that turned duds – the ones where he made mistakes.

How much time did it take for you to complete your research for the book? What were some of the biggest challenges therein? Did you make any surprising discoveries about the man during the research phase – uncovered something new, which even you weren’t aware of earlier?

Our publisher, Penguin, and we had decided to launch this book as the new financial year starts. Thankfully we could do it. We put in extra hours beyond our core job to work on the book. The major challenge we faced was getting hold of people who would talk about Jhunjhunwala. A lot of people declined our requests. Some of them who spoke to us didn’t want to go on record. We did use their stories but did not name them.

There were indeed some memorable conversations. One such conversation I recall is how Jhunjhunwala shared his card with a young stranger at Geoffrey’s (a bar at Marine Drive in Mumbai) who had come to him to say hello. This young person needed a job and wrote to Jhunjhunwala the same night. Within a week he had a job at Rare Enterprises and worked with RJ for a long time.

Another one is about how Jhunjhunwala would get himself admitted in hospitals so that he would stop drinking. He did try quitting drinking and smoking but old habits die hard. He could not do it.

What are the two or three most important things, according to you, that set RJ apart from all other successful stock market investors in India? Do you believe that sheer luck had at least some role to play in his massive success?

One, his conviction on his stock picks. The confidence with which he would hold on to his stock ideas through bull and bear market cycles was incomparable. Second, his ability to take leveraged bets. Very few people can handle leverage in the stock market. Third, his ability to book losses. He wouldn’t marry his stock ideas. If he felt he made a mistake, he would immediately sell. There is a lot that makes him an outstanding stock market investor and trader.

I cannot comment on luck. I believe luck favours the prepared. It was Jhunjhunwala’s own skills that stood him apart.

As someone who’s been a financial journalist for a decade, do you believe RJ’s style of investing and approach to the stock market can be studied, the patterns analysed and the success replicated by anyone who’s willing to take a long-term approach to investing? Was it that man who mattered, or his methods?

It was surely his methods first than the man. Replicating those methods require behavioural/psychological change. You cannot replicate him unless your risk appetite is strong. That said, there cannot be another Rakesh Jhunjhunwala just by replicating his style of investment. The unique bent of mind with which he could do trading and investing both is remarkable. No matter how much one reads or analyses it, one cannot do it for it involves behavioural/psychological aspects. Even Harshad Mehta was amazed at the way he could become an investor at the turn of the century after being a trader all through the ’90s.

Do you yourself read a fair number of books? What kind of books do you enjoy reading? Any favourite genre? Favourite authors? Any favourite Indian authors?

I do love reading books. I have a small library at home, although I don’t get to read as much as I used to when I was a student. I am guilty of buying more books than I can read and I prefer non-fiction over fiction. I don’t restrict myself to genres; I read a variety of books. Lately, I have been reading finance-related books more because it helps me in my profession. I have a target to read at least 12-15 books this financial year and I have finished one already. Michael Lewis is my favourite author. I want to explain finance the way he does. He is an inspiration. In India, journalist and author Vivek Kaul has this magic in his writings, be it media articles or books.

Would you like to name the three most memorable, outstanding books that you’ve read in the last 1-2 years?

The Bee, the Beetle and the Money Bug by Adhil Shetty and AR Hemant, and Let’s Talk Money by Monika Halan are two books that I recommend to everyone. Most people I know lack financial knowledge and get serious about it only after making mistakes. These books will help them not commit those mistakes.

Also, Lean In by Sheryl Sandberg and Limitless by Radhika Gupta. Being an ambitious woman in is not easy at a personal and professional level. These books motivate you to be better. Their stories made me realise I am not alone. I keep gifting these books to my younger friends. These books are not just meant for women. Men should also read it.

The Happiness Curve: Why Life Gets Better After 50 by Jonathan Rauch. Stuck in a midlife crisis? Read this book.

The Big Bull of Dalal Street is due to be released later this month. You can pre-order the book on Amazon now

More Stories:

adventure advertising Allahabad Apple astrology audiobooks Banaras best-of lists Bombay book marketing business Calcutta cheap reads cityscapes corporate culture design fiction food Hinduism hippies history India Japan journalism journalists libraries literary agents memoirs memories money Mumbai music my life with books Persian photojournalism publishers publishing religion science-fiction self-help technology travel trends Varanasi wishlists